Japan's yen dips to 34-year low against US dollar

The Japanese yen has hit its lowest level against the dollar in decades, even after Japan's central bank announced a hike in interest rates.

Currency markets saw Japan's yen dip to its lowest point against the dollar in more than three decades on Wednesday.

The fall has raised speculation that authorities might intervene in market trading to prop up the currency.

What's happening with the yen?

The yen fell to 151.97 against the dollar — the lowest point since 1990 — before rallying slightly. The dollar was last down at 151.19.

In the past two years, the yen has weakened significantly from roughly 115 against the dollar before Russia's invasion of Ukraine.

In a historic shift in monetary policy, Japan increased interest rates this month for the first time since 2007. However, this has done little to stablize the falling price of the yen, given that Japan's benchmark interest rates remain among the lowest in the developed world and are not expected to rise much further.

A weaker yen makes exports from Japan cheaper. However, it also drives up import costs and energy prices for consumers in the world's fourth-largest economy.

In a sign of concern about the need to shore up the currency, the Bank of Japan, the Finance Ministry, and Japan's Financial Services Agency held a meeting late in Tokyo trading hours.

Japanese Finance Minister Shunichi Suzuki said earlier that authorities could adopt "decisive steps" against yen weakness.

Bankrupt banks and higher interest: Are startups in crisis?

"Now we are watching market moves with a high sense of urgency," he told reporters.

The government could intervene directly in the currency market, buying large amounts of yen and usually selling dollars for the Japanese currency. Tokyo last took such action in 2022 when the yen was also floundering.

Why is the yen so low?

Japan last week raised interest rates for the first time since 2007 in a move that marked a historic shift in monetary policy.

Despite the rise in interest rates from negative territory, the cost of borrowing in Japan remains very low at 0 to 0.1%.

For investors, the US — which adopted an aggressive policy of hiking rates to tamp down inflation — offers a far more attractive rate of 5.25 to 5.5%, with a cut not priced in until July.

The value of the Japanese yen has already fallen more than 7% this year against the dollar.

Meanwhile, the dollar is on track for solid quarterly gains after investors tempered their expectations of big interest rate cuts in light of strong economic data and the reluctance from central bankers.

Comments

Pakistani Girls from Dawoodi Bohra community Continue to Grapple with Secretive Practice of FGM: Report

Pakistan Hikes Petrol, Diesel Prices Amid Public Outcry over Inflation

13 Soldiers Killed in Armed Attacks, BLA and BLF Claim Responsibility

11 Injured in Clashes as Karachi Police Attempt to Disperse Protests Against Parachinar Killings

Gold Prices Surge to Two-Week High, Reasons Revealed

Thousands Evacuate over Volcanic Eruption Fears in Ethiopia

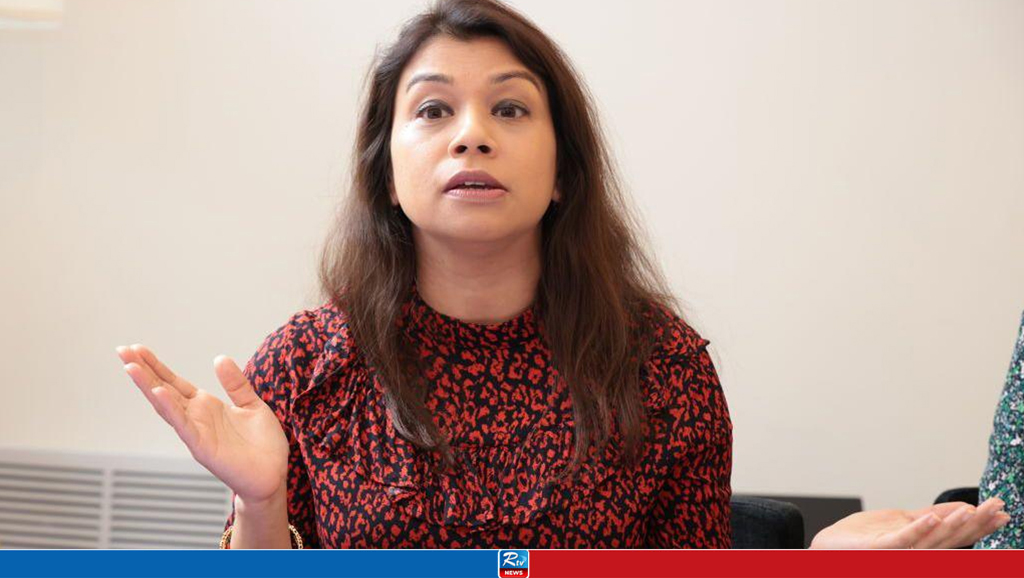

Gifted Flat Sparks Controversy: / Tulip Siddiq Under Scrutiny Over London Property

Live Tv

Live Tv