China’s top executives suffer first average pay cut in 2 decades as sluggish economy weighs on listed firms

The average annual salary of top executives at Chinese listed companies fell for the first time in two decades last year, according to a study of over 5,000 annual reports, as companies’ profitability was dented by the sluggish economy.

The average last year stood at 1.66 million yuan (US$229,000), representing a 3.27 per cent decrease from 2022, according to the study by Shanghai Rongzheng Enterprise Consulting Service Group released on Tuesday.

The study also showed the average annual pay for chairmen fell by 3.32 per cent from 2022 to 1.32 million yuan last year, while salaries for general managers, board secretaries and chief financial officers declined by 3.46 per cent, 1.12 per cent and 3.82 per cent, respectively.

The consulting firm has been tracking executive pay at Chinese listed companies since 1999. Its findings were drawn from the annual reports of 5,326 listed companies published as of April 30.

The highest-paid executive last year was Li Ge, chairman of biotech firm WuXi AppTec, who earned around 42 million yuan before tax, which was about the same amount he received in 2022.

His salary easily eclipsed the 26.63 million yuan earned by Li Xiting, the chairman of medical equipment manufacturer Mindray Bio-Medical, and the 26.28 million yuan for Li Bin, the vice-president of agricultural and technology firm Tongwei.

Li Bin was the best-paid executive in 2022 with a salary of 86.5 million yuan, but suffered a nearly 70 per cent pay cut last year.

Remuneration for executives at several other firms, including dairy giant Yili Group, pharmaceutical firm BeiGene and electrical appliance manufacturer Midea Group also topped the 10 million yuan threshold.

The overall dip in pay, though, mirrored broader patterns of stagnating or falling wages in China in the last year, as companies navigated the third year of an economic downturn and turbulent market conditions.

Overall, net profits for listed companies last year fell by 1.45 per cent from 2022, Rongzheng’s report said.

A survey released in March by professional services firm KPMG China of around 1,110 business executives and professionals based in mainland China and Hong Kong found that only about 53 per cent received a pay increase last year.

The survey also showed 40 per cent saw no change, while 7 per cent suffered pay cuts.

At the C-suite level, only 19 per cent received a salary increase of 10 per cent or more, compared with 23 per cent in 2022.

The decline has been particularly felt in the financial sector, which has been a primary target of Beijing’s crackdown on corruption and excess, with salaries at China’s 10 biggest brokerages all falling last year.

Pay was also slashed at struggling Chinese property giant Vanke, where eight senior executives voluntarily gave up their annual bonuses for 2023 in light of the company’s net profits having plunged by 46.4 per cent from the year before.

Three of its top executives, including chairman Yu Liang and president Zhu Jiusheng, also said they would voluntarily reduce their salaries this year to 10,000 yuan (US$1,379) per month before tax, according to Vanke’s annual report released in March.

Between 2017, when Yu became the chairman of the state-backed developer, and 2020, he received an annual salary of over 11 million yuan, peaking at 12.53 million yuan in 2018, according to financial data provider Wind.

In 2021, following the coronavirus pandemic and property market downturn, Yu gave up his annual bonus, taking home a salary of around 1.45 million yuan that year, according to Vanke’s annual report.

Overall, the use of equity incentive schemes at A-share firms – companies listed in Shanghai or Shenzhen – fell by around 14 per cent from 2022, encompassing the use of incentives as well as stock options and restricted stocks, according to Rongzheng’s report.

“The data also reflects that domestic market confidence has not been fully restored in 2023,” Rongzheng wrote on its official WeChat account, adding that it nonetheless believed the use of equity incentives would pick up again.

Source: South China Morning Post

Comments

Israel's Attack: All Flights from Iranian Airports Suspended

Israel Announces End of Attacks on Iran in Face of Resistance

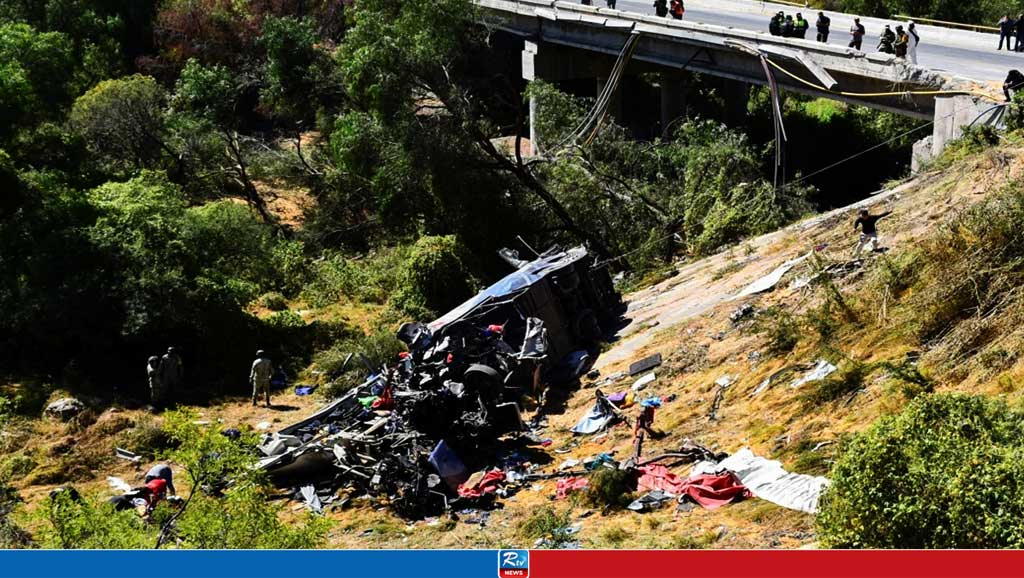

19 Killed in Passenger Bus Accident in Mexico

Tropical Storm Trami Claims 126 Lives, Hundreds Missing in Philippines

Elon Musk Reveals Tesla 2025 Motorhome for UNDER $17,000

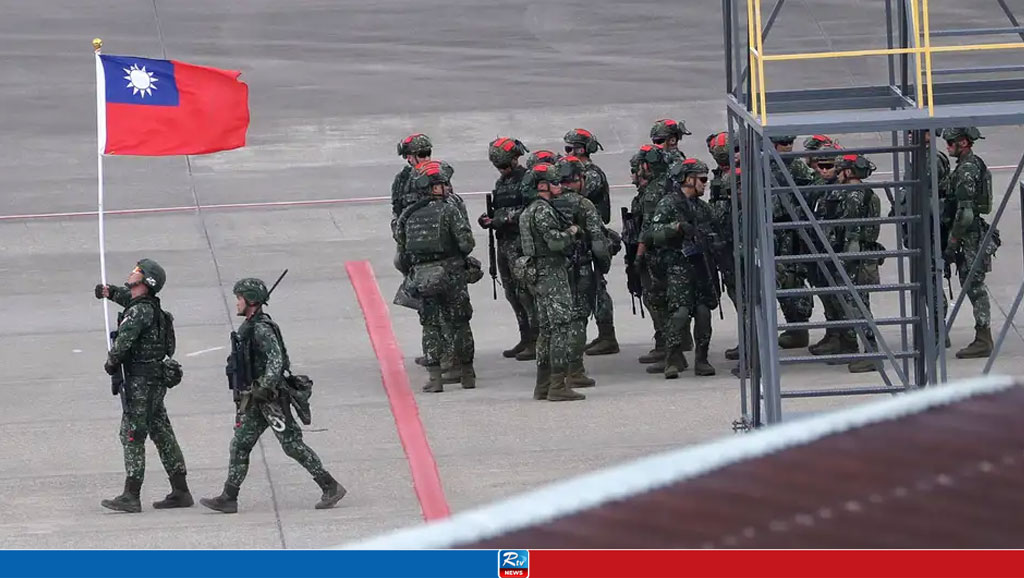

China Vows Countermeasures after US Arms Sale to Taiwan

Elon Musk's 8 Top Innovations: From Tesla to SpaceX

Live Tv

Live Tv