Banking Sector Reforms Underway, Customers Confidence Being Restored

The banking sector has been on the path of development since the interim government took over. Looting in the name of loans has stopped, and customers are regaining confidence in deposits. As a result, the liquidity crisis has started to decrease.

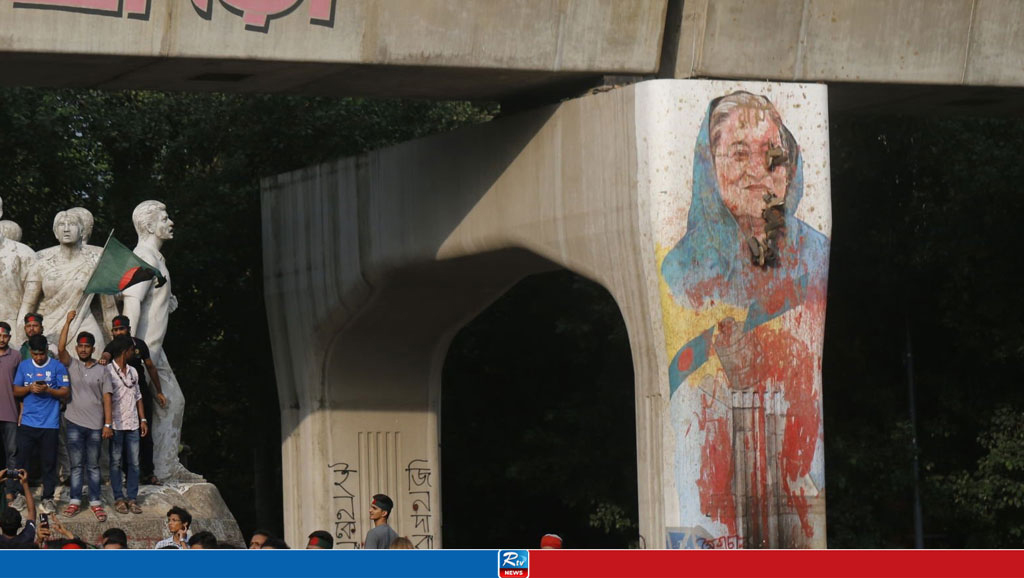

Under the leadership of the dictator Sheikh Hasina, the Awami misrule of almost 16 years has been the festival of looting and money laundering. A large part of this was taken from the bank by the party leaders and workers in the name of fake company loans. Several banks are now on the verge of bankruptcy due to such unusual looting.

But hopefully, the banking sector has started to turn around since the interim government took over. According to the data of Bangladesh Bank, at the end of last August, 43 banks out of 61 scheduled banks have excess liquidity, amounting to Tk 1 lakh 90 thousand 306 crores.

Excess liquidity in five state-owned banks is Tk 63 thousand 670 crore. Of this, only Sonali Bank has 49 thousand 43 crores. 31 private banks have 91 thousand 674 crore taka. Besides, additional liquidity in 9 foreign banks is 34 thousand 677 crores.

Banking sector expert Dr Toufic Ahmad Choudhury said that the owners or the board used to collect deposits from all the employees. Then they took them under the name of sharing and lending. As these are stopped, the confidence of the customers is returning. As a result, deposits in banks are also increasing.

Towfiqul Islam Khan, Senior Research Fellow of Center for Policy Dialogue (CPD) said, that if the hide-and-seek game that has been going on in the banking sector for a long time is not overcome, people's trust will not be returned.

Mahfuz Kabir, the research director of the Bangladesh Institute of International and Strategic Studies (BIISS) said that Banking

Comments

Hasnat-Sarjis in Road Accident

SSC Form Fill-up Fee Increased

Gold Prices Suddenly Volatile, Reason Revealed

Panchagarh Records Season's Lowest 10.4°C as Winter Intensifies

UK Properties Worth Millions Linked to Hasina's Inner Circle

Tourist Ship Services Begin on Cox's Bazar-Saint Martin's Route

Gold Price Today (December 3)

Live Tv

Live Tv