Kenya's economic crisis exposes debt burden amidst increasing Chinese influence

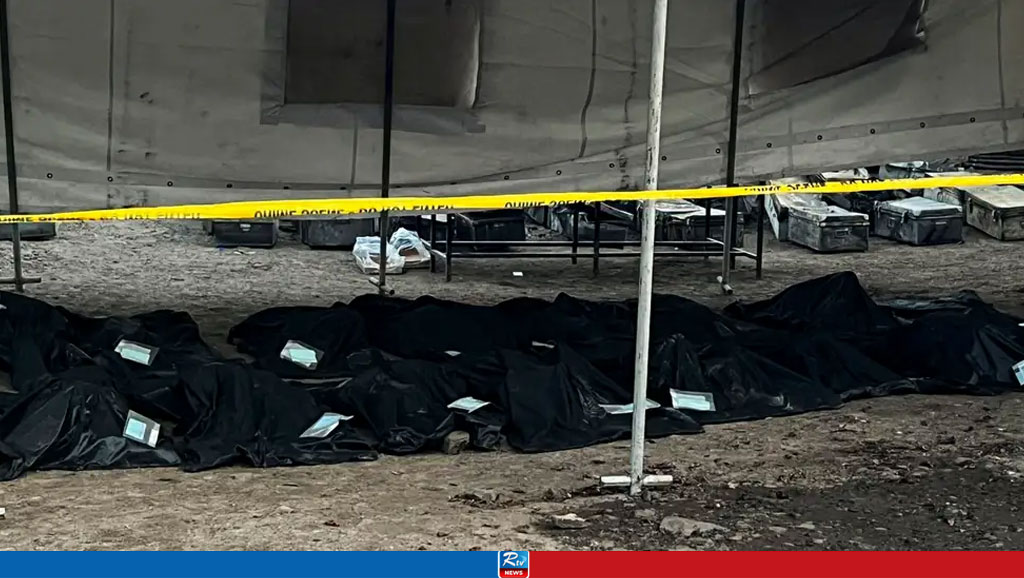

East Africa's Kenya experienced widespread violent protests last week during which at least 19 people lost their lives.

The Kenyan debt crisis underscores the challenges faced by many African nations in balancing development goals with financial stability.

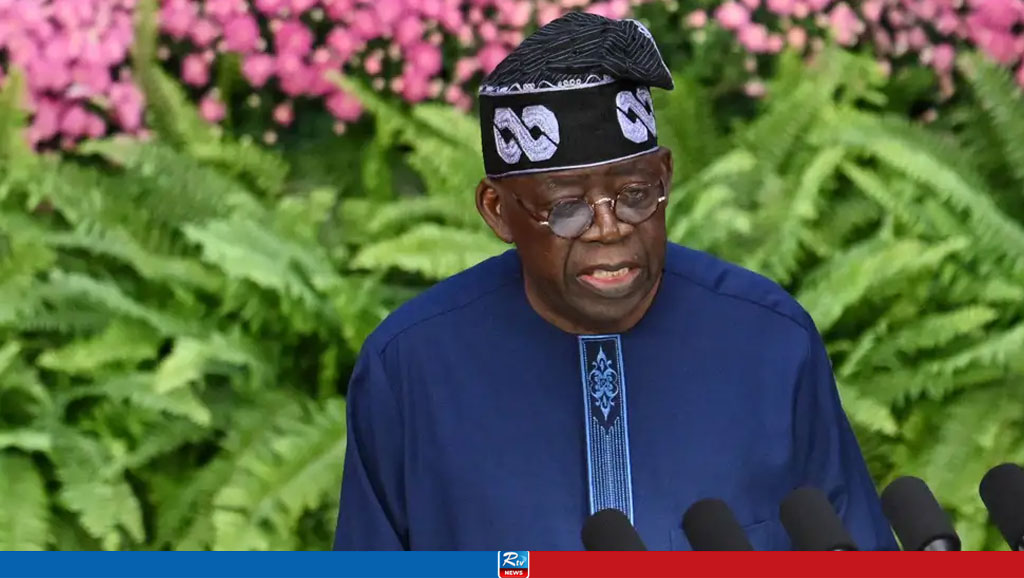

Kenya, known as East Africa's one of the more economically developed and politically stable countries, experienced protests where demonstrators expressed their anger against President William Ruto, demanding his resignation due to the introduction of the Finance Bill 2024, which included tax hikes, Ruto temporarily suspended the controversial tax bill in response to public outcry.

According to a report by USA-based Vox media, Kenya's total debt amounts to USD 80 billion, comprising both domestic and foreign debt. This debt represents 68 per cent of Kenya's GDP, exceeding the World Bank and IMF recommended maximum of 55 per cent.

With the withdrawal of the Finance Bill, President Ruto needs to outline new measures to address the debt crisis. He has mentioned austerity measures but must strike a balance between meeting the needs of the Kenyan people and satisfying the country's creditors.

The crisis was triggered by the Kenyan government's attempt to pass an IMF-backed finance Bill that proposed increasing taxes on various goods, including imported sanitary pads, tyres, bread, and fuel. The Bill aimed to raise an additional 200 billion Kenyan shillings (approximately USD 1.55 billion) to service the country's debt.

Most of Kenya's debt is held by international bondholders, with China being its largest bilateral creditor, owed USD 5.7 billion. Kenya's debt situation stems from heavy borrowing to finance infrastructure projects. The country has borrowed from multinational lenders like the World Bank and IMF, as well as bilateral partners such as China. The COVID-19 pandemic and the Ukraine war further exacerbated the situation, leading to increased expenses and a spike in global food and energy prices.

The issue of debt has sparked international scrutiny, with Washington frequently accusing Beijing of engaging in "debt trap diplomacy" through its infrastructure investments under President Xi Jinping's Belt and Road Initiative. China, however, denies these allegations.

Kevin P Gallagher, director of Boston University's Global Development Policy Center, highlighted the lack of a well-functioning global financial safety net as a significant factor contributing to Kenya's debt challenges.

Aly-Khan Satchu, a Kenya-based economist quoted by Voice of America, described Kenya as being in a "perfect debt storm," noting shifts in Kenya's geopolitical alignments and efforts to reduce dependency on Chinese financing with support from the World Bank and IMF.

However, Satchu also pointed out challenges arising from Kenya's need to allocate IMF and World Bank funds to repay debts owed to China, particularly related to infrastructure projects like the Chinese-built railway.

The Sunday Guardian cited Paul Nantulya from the Africa Center for Strategic Studies, who highlighted China's substantial role in financing and building infrastructure across Africa.

Concerns arise when African countries struggle to repay these loans, potentially leading to asset seizures by China. Countries like Zambia and Ghana defaulted on their payments and subsequently reached agreements with their creditors to restructure their debt. These cases highlight the need for a balanced approach to debt management and economic stability.

Kenya's economic and political landscape remains fraught with challenges as it navigates its debt burden and seeks to manage its international relationships effectively. A collaborative approach involving fair taxation, debt restructuring, and international support is essential to navigate this crisis without further burdening the population.

Source: Daily Hunt

Comments

Tens of Thousands Join Student-led Protests in Serbia

Guam arrests 7 Chinese nationals who tried to illegally enter US military site during missile test

US Plans to Blacklist Company That Ordered TSMC Chip Found in Huawei Processor

8 Bangladeshi Die in Mediterranean Sea

Azerbaijan Airlines Plane Crashes Near Kazakhstan's Aktau Airport

At Least 40 Killed in Kazakhstan Plane Crash, Report Says

China Launches New Generation Assault Ship 'Sichuan'

Live Tv

Live Tv