Rise and Fall of China's Manufacturing Empire

China's dominance in global manufacturing is evident, contributing nearly one-third of the world's manufacturing value-added and one-fifth of global exports.

However, signs suggest an imminent decline. Drawing parallels with Japan's post-WWII history, Japan's manufacturing thrived due to access to the U.S. market.

Yet, the 1985 Plaza Accord, which strengthened the yen and weakened exports, along with an aging population and shrinking labor force, reversed this growth. China may face a similar trajectory.

Between 1985 and 2022, Japanese goods' share in U.S. imports plummeted from 22% to 5%, while Japan's global manufacturing exports fell from 16% to 4%.

Additionally, Japan's global manufacturing value-added dropped sharply from 22% in 1992 to 5% in 2022. The number of Japanese companies on the Fortune Global 500 list also decreased from 149 in 1995 to just 10 today.

China has experienced a similar trend, with its manufacturing rise heavily reliant on the U.S. market. Japan's imports from the U.S. were 51% of its exports in 1978-84, compared to China's 23% in 2001-18.

China's family-planning policies, particularly the one-child policy from 1980 to 2015, have significantly contributed to economic imbalances. Typically, household disposable income should be 60-70% of GDP to sustain household consumption at around 60%. However, in China, the one-child policy limited household earnings promoted high savings, and restricted domestic demand. Consequently, household disposable income fell from 62% of GDP in 1983 to 44% today, with consumption dropping from 53% to 37%.

In contrast, Japan's household consumption is 56% of GDP. Essentially, if wages should be $60-$70. Chinese workers earn only $44 and have $37 for spending, while Japanese workers have $56.

China's government has substantial financial resources to support industrial subsidies and manufacturing investments. The high returns in China's manufacturing sector attract international investors, leading to significant capital inflows. With a surplus of about 100 million workers, excess capacity is inevitable. Due to insufficient domestic demand, China must maintain a large current account surplus to reduce excess capacity and create jobs.

This is where the U.S. plays a crucial role: Chinese goods share in U.S. imports rose from 1% In 1985 to 22% in 2017, with the U.S. accounting for three-quarters of China's trade surplus from 2001- 18.

China's massive surplus contrasts sharply with America's deficit. While Chinese manufacturing isn't the sole cause of the US. manufacturing decline, it plays a significant role.

America's share of global manufacturing experts held steady at 13% from 1971 to 2000 but dropped sharply after China joined the WTO in 2001, reaching just 6% in 2022. Similarly, America's

manufacturing value-added share fell from 25% in 2000 to 16% in 2021.

These trends devastated the Rust Belt, fuelling frustration with globalization and political elites. In 2016, Donald Trump capitalized on this discontent, promising to revive U.S. manufacturing and challenge China's trade practices. He aims to do the same this November.

In this context, China's one-child policy has subtly yet significantly altered the American political landscape. Now, American politics are influencing China's economy in return. The backlash against China, which began with Trump's tariffs in 2018 and has gained momentum under President Joe Biden, has led to a decrease in the share of Chinese goods in U.S. Imports, dropping to just 12.7% in the first half of 2024.

On top of losing access to the American market, China is also seeing some of its manufacturing firms relocating portions of their production to countries like Vietnam and Mexico to sidestep U.S. tariffs. This trend hints at a broader exodus reminiscent of the decline experienced by Japan's manufacturing sector.

China is beginning to resemble Japan for a couple of key reasons.

First, its workforce is shrinking and aging at an alarming rate.

Government statistics show that annual births have plummeted from an average of 23.4 million between 1962 and 1990 to just 9 million last year, a figure that is likely overstated. In just a few years, China may see only about 6 million births annually.

Meanwhile, the median age of migrant workers, who make up 80% of the manufacturing om 34 in 2008 to 43 last year, with those over 50 rising from 11% to 31%. Some manufacturing plants are already shutting down due to labor shortages.

Second, the services sector is poised to overshadow manufacturing. As the Chinese government aims to boost the share of household disposable income in GDP, demand for U.S. goods is expected to rise. Additionally, many manufacturing workers may transition to the services sector, which is where a rapidly growing number of college graduates will seek employment.

The drop in manufacturing may not occur as swiftly as it did in Japan, thanks to China's larger domestic market and more developed industrial ecosystem.

Additionally, the country's significant investments in artificial intelligence and robotics could lead to productivity improvements. Nevertheless, a decline is both unavoidable and permanent.

Unfortunately for the U.S., this situation is unlikely to result in a resurgence of domestic manufacturing.

Comments

Philippines: Cyclone Kristine Leaves More Than 20 Dead

Taiwan 'Will Not Yield an Inch' of Land, Lai Says

Israel's Attack: All Flights from Iranian Airports Suspended

Israel Announces End of Attacks on Iran in Face of Resistance

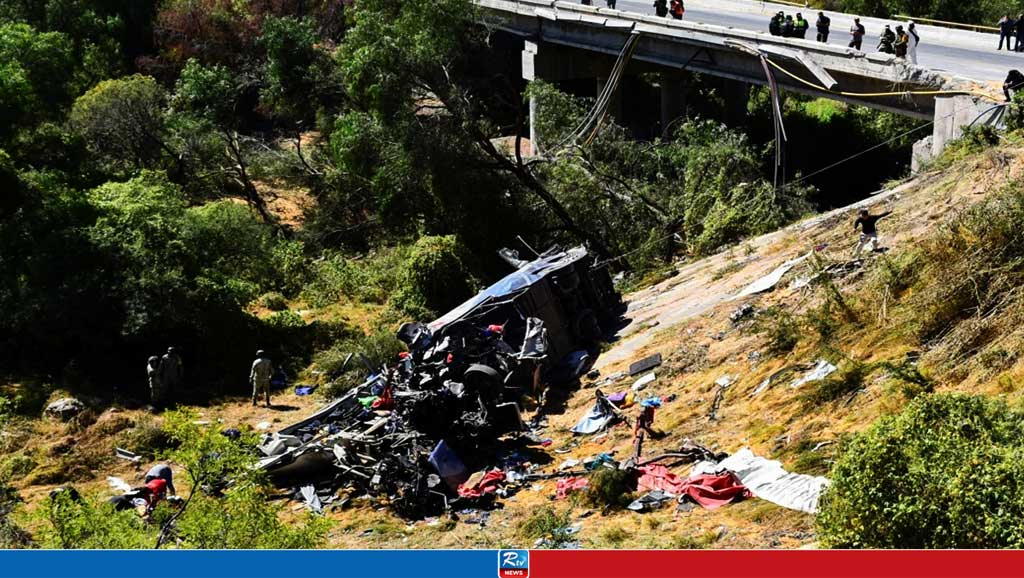

19 Killed in Passenger Bus Accident in Mexico

Tropical Storm Trami Claims 126 Lives, Hundreds Missing in Philippines

Elon Musk Reveals Tesla 2025 Motorhome for UNDER $17,000

Live Tv

Live Tv