China’s housing crash could set back millions of promising careers

Ms Ivy Zhang figured she had it made. Fresh out of school after studying chemistry, she joined one of China’s biggest property companies in 2016, as the country’s real estate market was taking off.

She worked until 11pm every day and was transferred to a bigger city after being designated a “sales champion”.

She pampered herself in her limited time off by regularly buying US$550 (S$740) spa packages. Money was so plentiful that she did not have to think about it much.

“The bank account was just a series of numbers,” Ms Zhang said.

Everybody wanted what Ms Zhang and her colleagues were selling.

Owning property was so essential it was often a prerequisite for marriage. Prices never seemed to fall, so condominium units served the combined functions of wealth storage, insurance and retirement savings.

Real estate at one point accounted for about a quarter of gross domestic product (GDP), according to Bloomberg Economics. Some estimates were even higher.

But those heady days did not last. Even though Chinese President Xi Jinping warned that “houses are for living in, not speculation”, by 2021 developers were selling homes faster than they could build them and piling on debt in search of expansion.

When the government suddenly cracked down on borrowing, it all fell apart. Many home buyers were left waiting on stalled construction, sparking angry protests across the country.

Developers including Country Garden Holdings and the collapsed giant China Evergrande Group defaulted on bond debts.

Government revenue plunged. Images of tracts of empty buildings and uncompleted public works became global symbols of the nation’s waning confidence and disgruntlement over Mr Xi’s handling of the world’s second-largest economy.

And a cohort of young professionals who thought they had found an escalator to China’s affluent middle class had their lives upended.

What seemed like a lifelong career turned out to be a moment in a bubble. The slump has tossed some 500,000 people out of the property sector in the three years through 2023, according to Ke Yan Zhi Ku, a real estate research group.

That is not counting workers in related industries such as construction and marketing.

They are all facing setbacks in the middle of their careers, forced to make skill adjustments “on an epic scale”, said Mr Alex Capri, senior fellow at the National University of Singapore.

He added: “The property meltdown is feeding a wider sense of sombre reflection.”

The days when some real estate companies doled out Mercedes-Benzes as year-end bonuses are a distant memory, but many analysts say this is not rock bottom yet.

The housing sector’s economic heft may shrink to about 16 per cent of China’s GDP by 2026, according to Bloomberg Economics. That possibility threatens to put about five million people – equal to the population of Ireland – at risk of unemployment or reduced incomes, the analysts wrote.

Even young workers in their prime are struggling to find jobs, with the youth unemployment rate reaching 15.3 per cent after China revised its data methodology.

“People are very depressed and scared,” said Ms Anne Stevenson-Yang, co-founder of J Capital Research. “The situation is very severe.”

Ms Zhang, 30, who said she helped sell almost 1 billion yuan (S$187.3 million) worth of apartments for Country Garden, has resorted to peddling health supplements on social media to pay the bills.

So far she is earning nowhere near enough, selling three items a month.

It is a far cry from the days when she earned as much as the equivalent of US$83,000 a year.

She and her husband have postponed having a baby, and she scours the web for discounted offers, cooks her own meals to avoid takeaways and minimises socialising to cut expenses.

“If you still want to live like before, you’re basically dreaming,” Ms Zhang said. “If I spent 3,000 yuan in the past, now I’m looking to see if I can cut it down to 2,000. Then I’ll see if I can cut it to a thousand. As long as I can survive.”

The pain is not limited to salespeople.

Mr Ivan Li, 28, lost his position as an investor relations manager in Hong Kong twice.

Most developers stopped issuing dollar bonds in the US$203 billion market, among the biggest in the world for high-yield debt when times were good. Investors ceased buying the asset class as prices cratered, and communication between debt holders and companies petered out.

“Gradually, as the crisis grew, you could feel that engaging with the likes of overseas investors and analysts became the least of management’s concerns,” Mr Li said.

Mr Charlie Zeng, a former worker at developers including China Vanke, who in a good year earned the equivalent of more than US$250,000, spent a year looking for work.

In his most desperate moment, he volunteered to take a 90 per cent pay cut.

After 70 interviews, he received a few offers, only to have them all rescinded.

Although he eventually found a job, he remains pessimistic about real estate. “There’s no future in this industry,” Mr Zeng said. “The sector’s been abandoned.”

Apartment and commercial property sales in 2024 are expected to tank 45 per cent from 2021, according to data compiled by Bloomberg and estimates from Fitch Ratings.

The value of new home sales from the 100 biggest real estate companies was down about 45 per cent in April from a year earlier.

Even China Vanke – once seen as a sure-fire survivor given its state backing – is coming under pressure, with its credit rating cut to junk status.

Another way to measure the bleak market is to look at rental yield, or the annual return from renting out an investment property.

The rate is only 1.5 per cent in the biggest cities in China, about half that of Hong Kong and well below the almost 5 per cent in New York, according to a report from ANZ Group Holdings. This low rate gives investors little motivation to buy a condo.

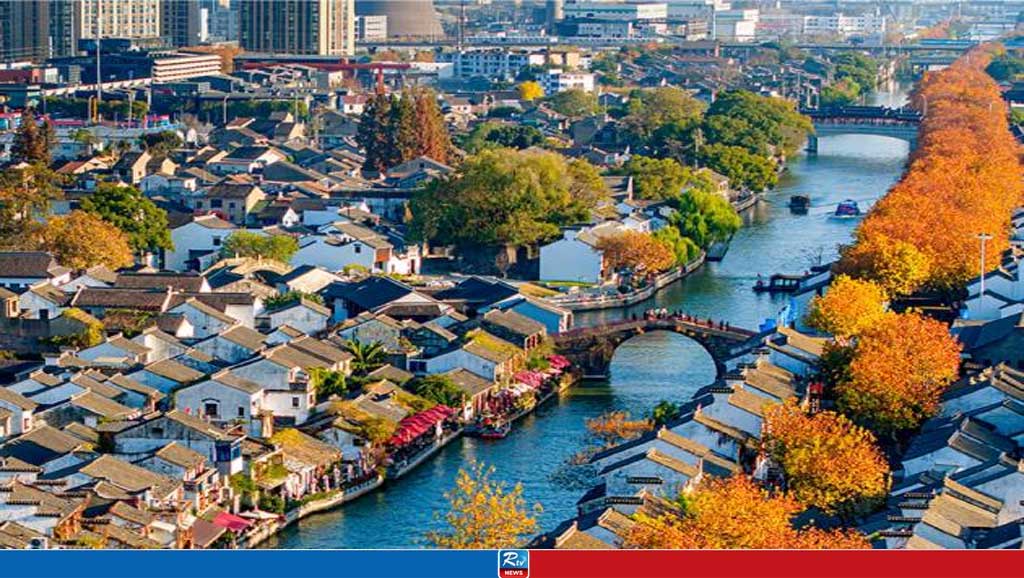

There are strands of optimism. Some local governments have relented on measures to cool speculation, scrapping buying curbs in some of the bigger cities including Hangzhou, the home base of Alibaba Group Holding.

Another hope may lie with government-backed companies such as Poly Property Group, as the Communist Party asserts its dominance over all aspects of the economy.

Nine of the top 10 land buyers in the first two months of 2024 were state-owned developers, with China Resources Land being the biggest purchaser, according to a research note by Mr Andrew Chan and Mr Daniel Fan at Bloomberg Intelligence.

The Chinese government has identified two pillars of its renewed housing policy: building affordable homes and renovating run-down inner-city districts.

The central bank is providing cheap funding for these efforts via the so-called pledged supplemental lending programme, with about 3.4 trillion yuan available as at the end of January.

The downward pressure on home prices may ease as early as 2025 if these renovation programmes go well, according to UBS Group analyst John Lam, an early Wall Street bear on Evergrande who is now one of the few analysts to have turned positive on Chinese real estate.

Shares of Chinese developers jumped sharply on May 16 on news that China is considering a plan for local governments to buy unsold homes.

“Shifts in the growth model of the real estate sector can help facilitate its recovery and mitigate the severity of job losses,” said Assistant Professor Maggie Hu at the Chinese University of Hong Kong.

Yet “there’s potential for the situation to worsen in the short term”.

Chances of a rebound provide little solace for workers such as Mr Li, who is still hunting for a job.

“In the good old days, success was a lot easier to achieve,” he said. “In wintertimes, one needs to work much harder and be mindful of every step and decision they make.”

Source: BLOOMBERG

Comments

Chinese doctors claim to cure diabetes with cell therapy

Australia: Man arrested after running naked through plane

Two Arrested in Money Laundering Scheme Tied to Chinese Entities and Mexican Drug Cartels

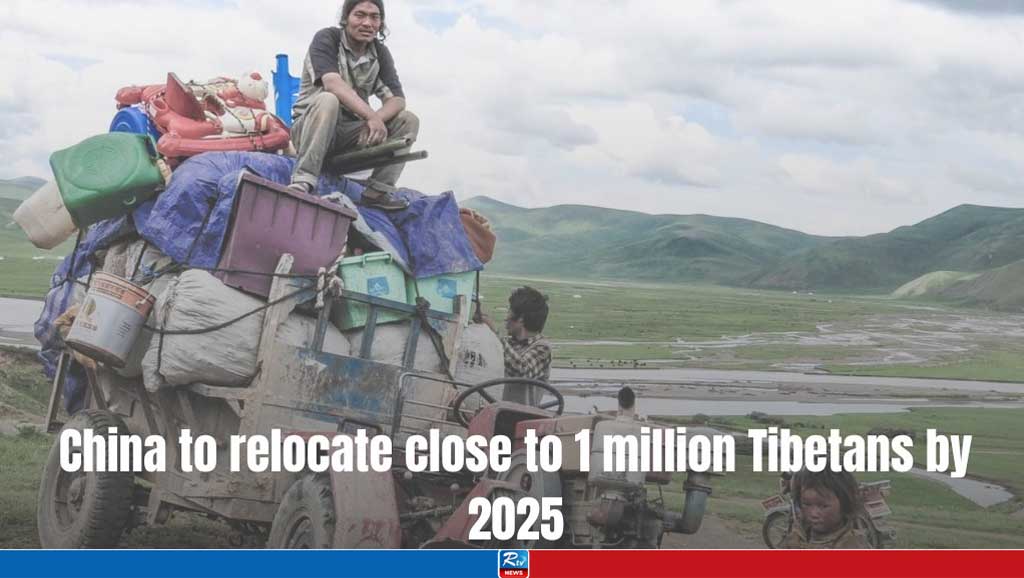

China will relocate close to 1 million rural Tibetans by 2025: HRW report

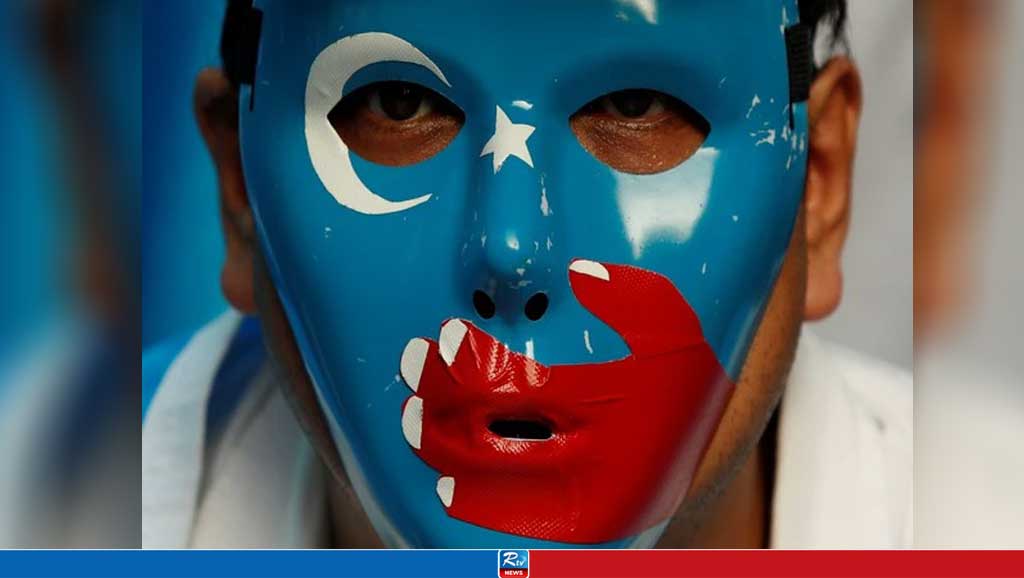

World Uyghur Congress condemns Hong Kong Court's pro-democracy activist sentencing

Southern Germany hit by catastrophic flooding

China state firms targeted by U.S. lawmakers for allegedly helping Iran

Live Tv

Live Tv